As Nvidia Struggles in China, One Thing Is Clear: It Can’t Afford to Walk Away

Amid mounting challenges in selling AI accelerator chips to China, questions are arising over whether Nvidia should continue trying to maintain a foothold in the world’s second-largest economy.

The answer, however, is clear: Nvidia simply cannot afford to exit the Chinese market.

In its recently released Q1 2025 earnings report, Nvidia delivered a pointed message to the Trump administration, warning of the risks posed by shutting American chipmakers out of China’s booming AI sector.

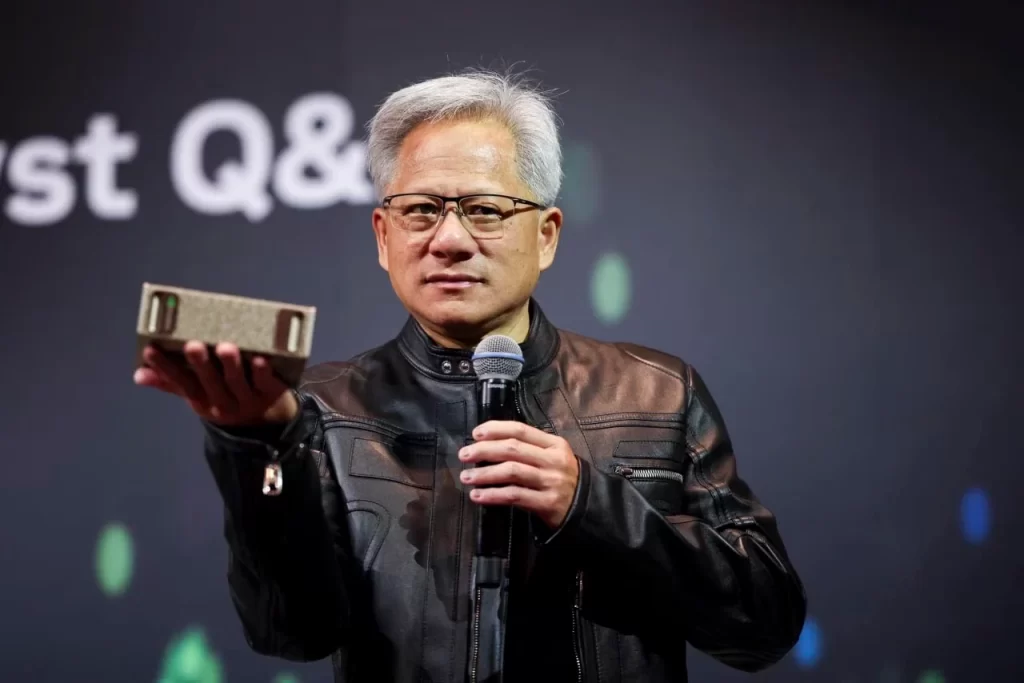

“China will continue to develop AI, with or without American chips,” CEO Jensen Huang said during the company’s earnings call. He emphasized that half of the world’s AI developers are based in China, and barring U.S. companies from competing there could ultimately undermine America’s leadership in global AI innovation.

“In the end, the platform that attracts AI developers will be the one that wins,” Huang added. “Export controls should strengthen U.S. platforms—not drive half the world’s AI talent toward competitors.”

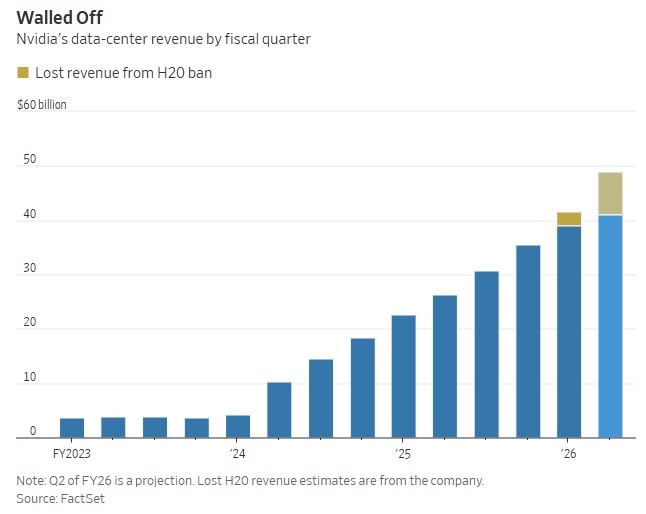

Nvidia also has a strong financial incentive to make that case. A U.S. government decision in April barred the company from selling its H20 chip to China—a chip specifically designed to comply with prior export restrictions. That move cost Nvidia an estimated $2.5 billion in revenue during the quarter ending in April, and the company expects to lose an additional $8 billion in the current quarter ending in July. Because the H20 is tailored exclusively for the Chinese market, it has limited demand elsewhere.

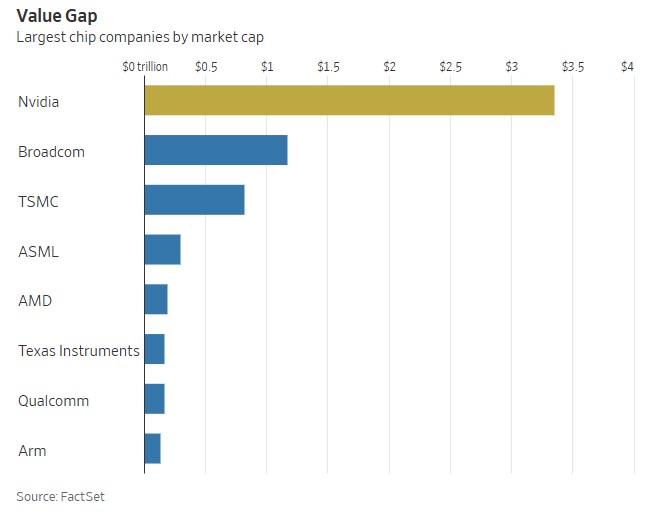

Despite surging global demand for AI chips, the loss of Chinese sales has yet to significantly dent Nvidia’s performance. The company’s market capitalization now exceeds $3.3 trillion—three times that of Broadcom, the second-largest U.S. chipmaker—driven by investor confidence in its long-term growth prospects. According to FactSet estimates, Wall Street analysts project Nvidia’s annual revenue to surpass $200 billion this year and reach $300 billion by 2028.

Such growth is difficult to achieve without China. The country is aggressively investing in AI development, fueled by state-backed enthusiasm and massive funding. According to a Morgan Stanley report released last month, Chinese government-led investment vehicles funneled $184 billion into AI startups between 2000 and 2023. Nvidia estimates the total addressable market for AI accelerators in China—its core product category—is around $50 billion.

“China represents about a quarter of the total market. That’s a huge number,” said Tim Arcuri, an analyst at UBS, in a recent interview. He noted that Nvidia would have a “dominant advantage” in China if it were allowed to compete freely there.

Wall Street remains hopeful that Nvidia will regain some access to China’s AI market. “We still believe there will be at least some recovery in Nvidia’s business opportunity in China,” Morgan Stanley’s Joe Moore wrote following the latest earnings release.

However, any such recovery would likely require a shift in U.S. policy. That appears unlikely in the near term, especially in light of recent developments. On May 30, President Trump accused China of violating the U.S.-China trade agreement, further escalating tensions and dimming hopes for a policy reversal.

UBS analyst Tim Arcuri believes that revisions allowing the sale of more powerful chips could still align with the administration’s objectives, given that ongoing restrictions on advanced chipmaking equipment continue to limit China’s practical ability to manufacture cutting-edge processors.

“As long as those equipment controls remain in place, there’s a natural ceiling on what China can achieve,” Arcuri said.

Nvidia’s absence from China’s AI market is already opening the door for domestic competitors such as Huawei. According to estimates from Morgan Stanley, Chinese firms are now able to meet approximately 34% of the country’s AI chip demand through local suppliers—a figure expected to rise to 82% by 2027. Even if Nvidia were to regain market access, the company would still face the broader ambitions of the Chinese government, which seeks to center homegrown technology at the heart of all key industries.

Nvidia remains years ahead of its rivals in both chip performance and development speed. Its growing chip ecosystem—including integrated systems and AI developer software tools—continues to be a major draw for Chinese companies seeking to stay competitive in the global AI landscape.

Nvidia needs to return to China. But the road back runs straight through the White House.